north dakota sales tax online

The average cumulative sales tax rate in the state of North Dakota is 577. This allows you to file and pay both your federal and North Dakota income tax return.

Red Lodge Label Nd Tax Permit Red Lodge Label

Depending on local municipalities the total tax rate can be as high as 85.

. Find out where your business may have created nexus with just three questions. Copyright 2022 North Dakota Office of State Tax Commissioner. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

The North Dakota ND state sales tax rate is currently 5. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program. North Dakota assesses local tax at the city and county.

Base State Sales Tax Rate. Groceries are exempt from the North Dakota sales tax Counties and cities can charge. According to the North Dakota Office of State Tax Commissioner the N o rth Dakota state sales tax rate is 5.

This top rate is the lowest of the states that have income tax. The state sales tax rate in North Dakota is 5000. Sales tax rates in north dakota.

North Dakota levies one of the lowest progressive state income taxes in the country with rates ranging from 11 to 29. North Dakota individual income. The cumulative North Dakota sales tax percentage is between 5 and 7 percent.

The North Dakota sales tax rate is 5. Find out where your business may have created nexus with just three questions. North Dakota levies a state sales tax rate of 5 percent for most retail sales.

With local taxes the total sales tax rate is between 5000 and 8500. Sales and use tax rates look up. This free and secure.

The state also allows cities and counties to levy an additional. The state general sales tax rate of north dakota is 5. North Dakota Sales Tax Ranges.

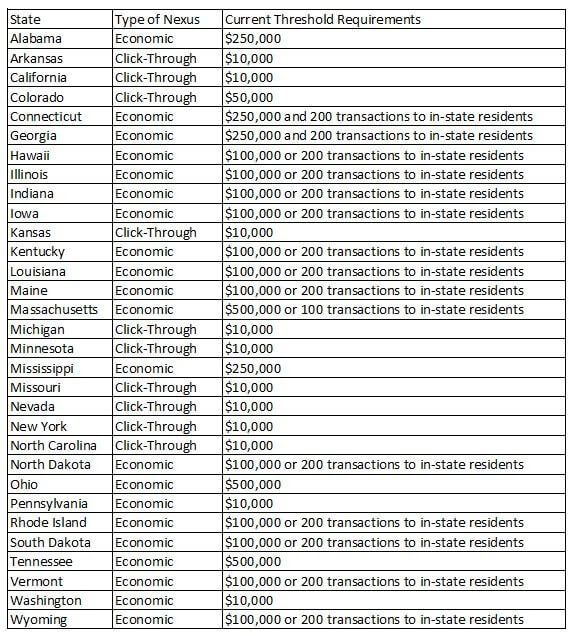

Ad Most states now require out-of-state sellers to collect and remit sales tax. 8 in the general election. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more.

You will have to comply with the state of North Dakotas individual sales tax laws and apply for a sales tax permit if. Ad Most states now require out-of-state sellers to collect and remit sales tax. The state sales tax rate in north dakota is 5000.

North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner. The current state sales tax rate in. City Measure 1 and City Measure 2 if approved would raise the sales tax rate to the highest in the metro area and will be voted on Nov.

This takes into account the rates on the state level county level city level and special level. 127 Bismarck ND 58505-0599 Main Number. Local Sales Tax Range.

To find the total sales tax rate combine the North Dakota state sales tax rate of 5 and look up the local sales tax rate with TaxJars Sales Tax. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

Certain items have different sales and use tax rates. The businesss primary location online store storefront office etc where. Just enter the five-digit zip.

The range of total sales tax rates within the state of North Dakota is between 5 and 8. North Dakota ND Sales Tax Rates by City. Use tax is also collected on the consumption use or storage of goods in North Dakota if.

Combined Sales Tax Range. Thursday June 23 2022 - 0900 am.

How To File And Pay Sales Tax In North Dakota Taxvalet

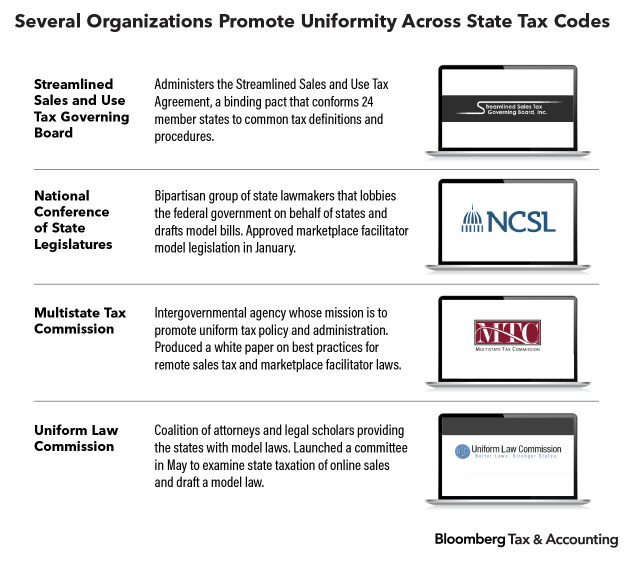

Online Sellers Lament Lack Of State Sales Tax Uniformity

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Internet Sales Tax Definition Types And Examples Article

South Dakota V Wayfair Collecting Sales Tax From Online Sales

Economic Nexus And South Dakota V Wayfair Inc Avalara

North Dakota Office Of State Tax Commissioner Bismarck Nd

Welcome To The North Dakota Office Of State Tax Commissioner

North Dakota Income Tax Calculator Smartasset

How To File And Pay Sales Tax In South Dakota Taxvalet

Sales Use Tax South Dakota Department Of Revenue

How To File And Pay Sales Tax In North Dakota Taxvalet

Form 21919 Application For Sales Tax Exemption Certificate

South Dakota V Wayfair Oral Argument C Span Org

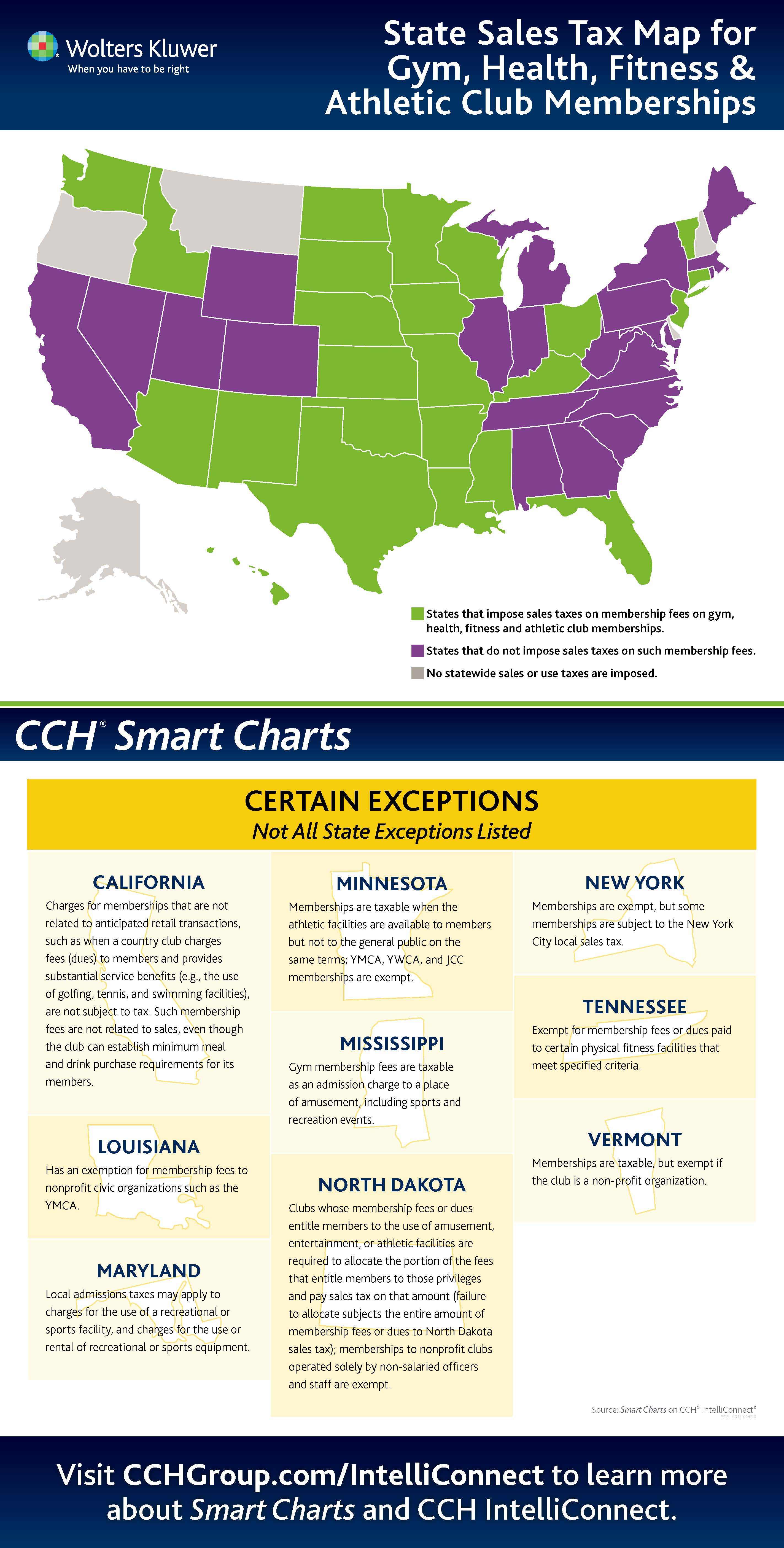

Media Alert Working Out At The Gym Really Can Be Taxing Depending On Where You Live Business Wire

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)