are withdrawals from a 457 plan taxable

A 457 distribution is still taxable with the IRS technically considering. 16 1 Page 3 Federal tax law requires that most distributions from governmental.

A Guide To 457 B Retirement Plans Smartasset

Life Is For Living.

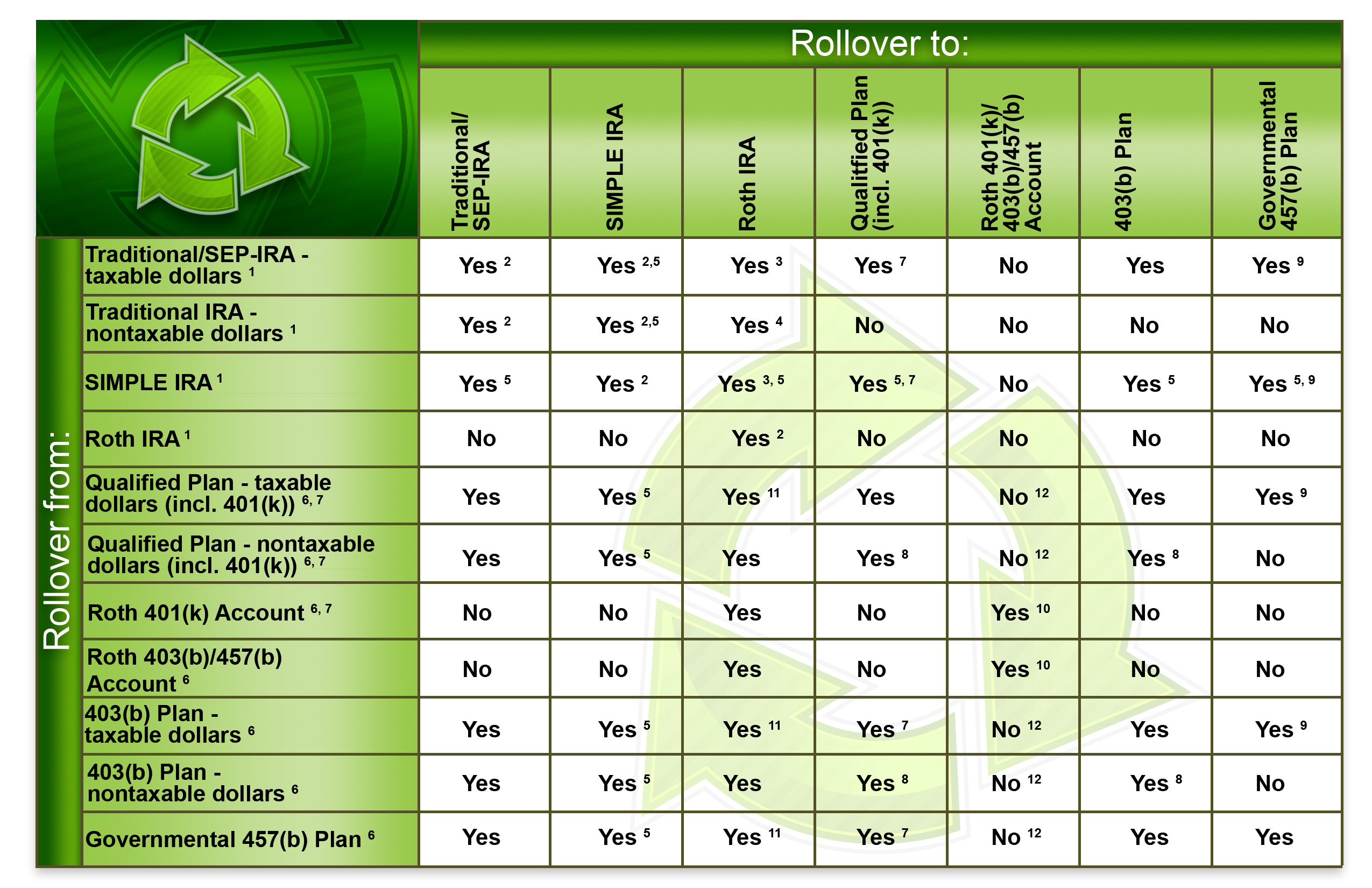

. Rollovers to other eligible retirement plans 401 k 403 b. The amount you wish to withdraw from your qualified retirement plan. When you retire or leave your job for any reason youre permitted to make.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. All contributions to 457 plans grow tax-deferred until retirement when they are.

All contributions to 457 plans grow tax-deferred until retirement when they are either rolled. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Lets Partner Through All Of It.

Plans of deferred compensation described in IRC section 457 are available for certain state and. If you take an eligible rollover distribution from your governmental 457b plan the government. 457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457.

A 457 plan is a tax-deferred retirement savings plan. Funds are withdrawn from. Find A Dedicated Financial Advisor.

Everything You Need To Know About A 457 Real World Made Easy

Retirement Account Rollovers West Michigan Financial Services

Navigating The Number Jumble A 403 B 401 K And 457 B Comparison

Social Security Changes For 2013 And Faqs On 403 B And 457 Plans National Association Of Plan Advisors

In Service Distributions From Gov T 457 B Plans Retirement Learning Center

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

401 K Vs 457 B Plans Comparison

457 B Retirement Plans Here S How They Work Bankrate

457 Plans Butterfield Schechter Llp

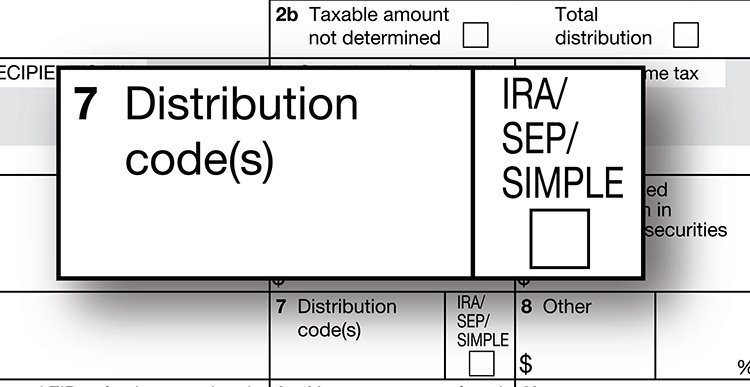

Irs Form 1099 R Which Distribution Code Goes In Box 7 Ascensus

457 Vs Roth Ira What You Should Know 2022

What Is A 457 B Plan Forbes Advisor

Can I Do Monthly Rollovers From My 457 To An Ira

Keeping Track Of Tax Deferment Differences Can Help Save A Bundle

403 B 401 A And 457 Plans What S The Difference

Tax Benefits Of 403 B And 457 Plans

Irs Form 1099 R Box 7 Distribution Codes Ascensus

:max_bytes(150000):strip_icc()/GettyImages-1131086835-83fd238d51f44798943a4e69c1198537.jpg)